Ind AS 115: Understanding Revenue Recognition Through the 5-Step Model

Revenue is the top line of any financial statement and a critical indicator of an entity’s performance. In India, Ind AS 115 – Revenue from Contracts with Customers provides a comprehensive framework for revenue recognition. It aligns with IFRS 15 and replaces earlier standards such as Ind AS 11 (Construction Contracts) and Ind AS 18 (Revenue).

Do you really understand when and how to recognize revenue under Ind AS 115?

Revenue isn’t just numbers—it’s the story of value delivered. Ind AS 115 ensures that story is told with clarity, consistency, and control.

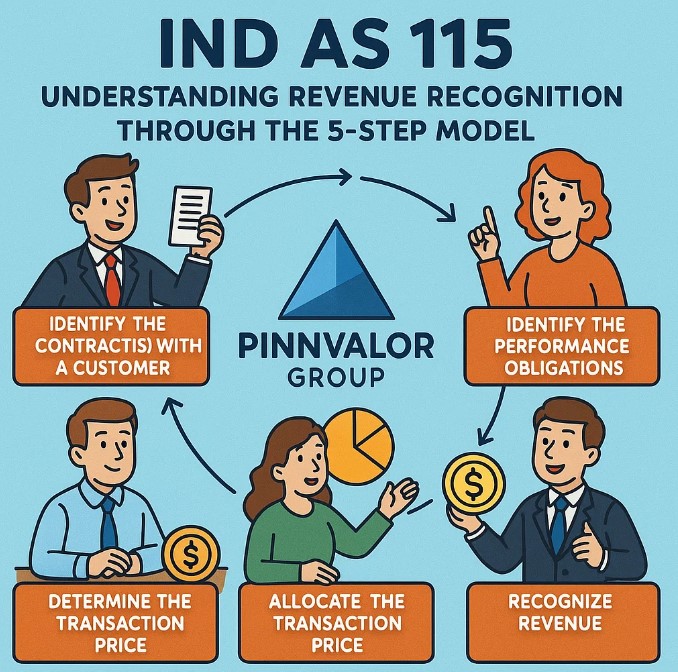

The core principle of Ind AS 115 is that revenue should be recognized when control of goods or services is transferred to the customer, in an amount that reflects the consideration expected in exchange. To apply this principle, Ind AS 115 introduces a five-step model.

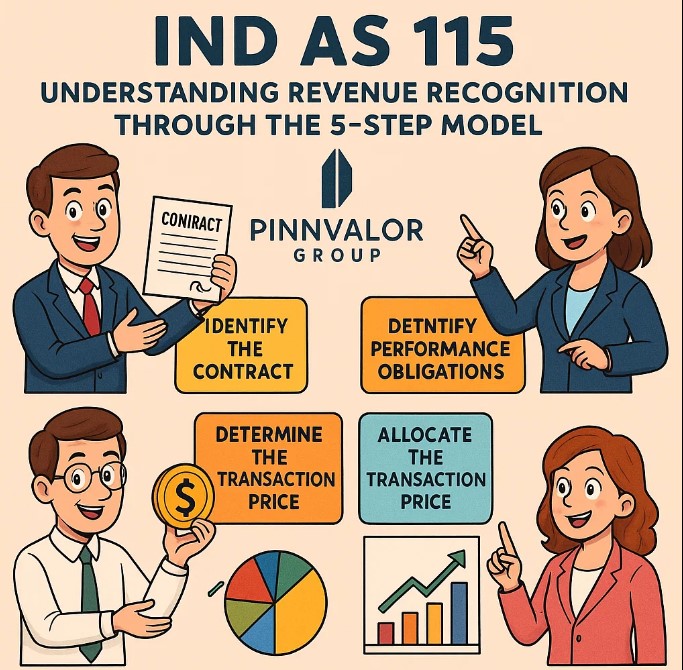

The 5-Step Revenue Recognition Model

Step 1: Identify the Contract with the Customer

A contract is an agreement that creates enforceable rights and obligations. It must meet the following criteria:

- Approval and commitment of both parties

- Rights of each party identifiable

- Payment terms identifiable

- Commercial substance

- Probable collection of consideration

Example: A retail company signs a formal agreement with a customer for the supply of 1,000 units of clothing over the next 12 months. This is a valid contract under Ind AS 115.

Step 2: Identify the Performance Obligations

A performance obligation is a promise to transfer a good or service to the customer. A contract may contain multiple obligations which must be accounted for separately if they are distinct.

Example: A software company sells software along with installation and technical support. If each service is distinct and can be separately used by the customer, each one is a separate performance obligation.

Step 3: Determine the Transaction Price

The transaction price is the amount the entity expects to be entitled to in exchange for transferring goods or services. It includes:

- Fixed amounts

- Variable consideration (discounts, rebates, bonuses)

- Significant financing components

- Non-cash consideration

- Consideration payable to a customer

Example: If a customer receives a volume discount of 10% for purchases exceeding 1,000 units, this must be factored into the transaction price as variable consideration.

Step 4: Allocate the Transaction Price to the Performance Obligations

If a contract has multiple performance obligations, the total transaction price is allocated to each based on their standalone selling prices.

Example: A telecom provider sells a handset and a 12-month service plan for ₹12,000. If the standalone prices are ₹6,000 (handset) and ₹8,000 (service), the revenue is allocated proportionally to these two elements.

Step 5: Recognize Revenue When (or As) Performance Obligation Is Satisfied

Revenue is recognized when control of the good or service is transferred. This can occur over time or at a point in time, depending on the nature of the performance obligation.

- Over time: Services like construction, subscription-based services

- Point in time: Sale of physical goods when delivered

Example: A construction company builds a custom home for a customer. If the customer controls the work in progress, revenue is recognized over time using the percentage of completion method.

Disclosure Requirements

Ind AS 115 also emphasizes enhanced disclosures to provide users with meaningful information, such as:

- Disaggregation of revenue

- Contract balances (receivables, contract assets, and liabilities)

- Performance obligations and timing

- Significant judgments and changes

Key Impacts of Ind AS 115

- Greater consistency across industries and contracts

- Alignment with international standards (IFRS 15)

- Potential timing changes in revenue recognition

- Need for systems and process updates for compliance

Conclusion

Ind AS 115 brings a unified and robust approach to revenue recognition. The five-step model ensures that revenue is reported in a manner that reflects the true economic substance of transactions. For businesses, this means not only compliance but also enhanced transparency and better decision-making for stakeholders.

Understanding and implementing Ind AS 115 effectively is essential for finance professionals, auditors, and management teams alike.