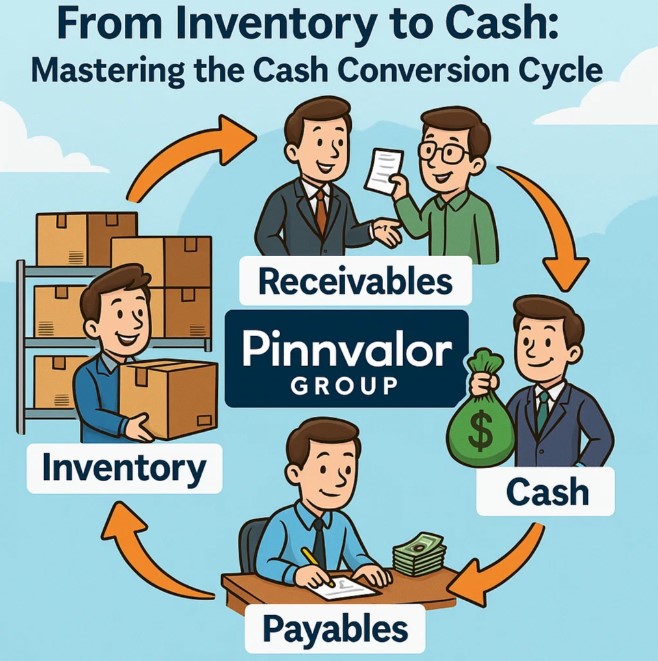

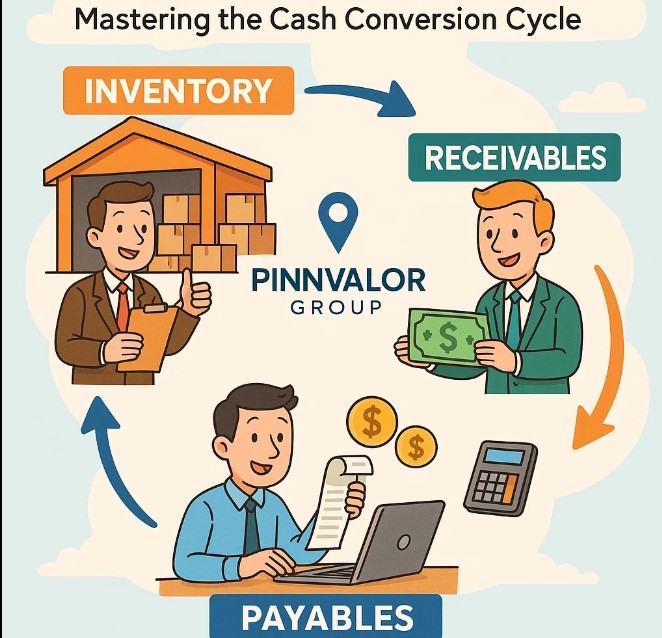

From Inventory to Cash: Mastering the Cash Conversion Cycle

Introduction

In business, cash is not just king—it’s survival. Even a profitable company can face trouble if cash doesn’t flow efficiently. That’s where the Cash Conversion Cycle (CCC) comes into play. It’s a powerful metric that helps businesses measure how quickly they can convert their investments in inventory and other resources into actual cash flow.

How fast can your business turn inventory into cash—and is it fast enough to stay ahead?

The faster you turn inventory into cash, the stronger your business becomes. Master DIO, DSO, and DPO for true financial freedom.

Whether you're a startup founder, financial analyst, or business owner, understanding the CCC can help you improve liquidity, streamline operations, and boost profitability.

In this blog, we’ll walk you through what the Cash Conversion Cycle is, break down its three core components, and show you how to optimize each step — from inventory to cash.

🔁 What Is the Cash Conversion Cycle?

The Cash Conversion Cycle (CCC) is a metric that measures the number of days it takes for a company to convert its investments in inventory and accounts receivable into cash — after accounting for the time it takes to pay its suppliers.

CCC Formula:

CCC = DIO + DSO - DPO

- DIO (Days Inventory Outstanding): How long it takes to sell your inventory.

- DSO (Days Sales Outstanding): How long it takes to collect payments from customers.

- DPO (Days Payable Outstanding): How long you take to pay suppliers.

A shorter CCC means your cash is tied up for less time — which is great for liquidity. A longer CCC means more of your money is stuck in operations, reducing your ability to invest or react to market changes.

📦 Step 1: Days Inventory Outstanding (DIO)

What is DIO?

DIO measures how many days, on average, inventory remains in storage before being sold.

Formula: DIO = (Average Inventory / Cost of Goods Sold) × 365

Why It Matters:

- Lower DIO = efficient inventory turnover

- High DIO = overstocking, slow sales, or inefficiencies

Optimization Tips:

- Use inventory management software

- Improve demand forecasting

- Eliminate obsolete or slow-moving inventory

💳 Step 2: Days Sales Outstanding (DSO)

What is DSO?

DSO calculates the average number of days it takes to collect payment after a sale is made.

Formula: DSO = (Accounts Receivable / Total Credit Sales) × 365

Why It Matters:

- Low DSO = faster payments, improved cash flow

- High DSO = poor credit policies or collection issues

Optimization Tips:

- Stricter credit checks

- Offer early payment incentives

- Automate invoicing and payment reminders

🧾 Step 3: Days Payable Outstanding (DPO)

What is DPO?

DPO tells you how long you take to pay your suppliers.

Formula: DPO = (Accounts Payable / Cost of Goods Sold) × 365

Why It Matters:

- Higher DPO = more cash retained temporarily

- Too high DPO = possible supplier issues or penalties

Optimization Tips:

- Negotiate better payment terms

- Use cash flow forecasting to schedule payments

- Use early payment discounts when appropriate

📊 Example: Cash Conversion Cycle in Action

Scenario:

- DIO = 40 days

- DSO = 25 days

- DPO = 30 days

CCC = 40 + 25 - 30 = 35 days

It takes this company 35 days to turn its inventory investment into cash. The shorter, the better.

✅ Why Mastering the CCC Matters

- Liquidity Control: Shorter CCC means better cash flow

- Operational Efficiency: Pinpoints where delays occur

- Investor Confidence: Healthy CCC = strong financial discipline

- Competitive Advantage: Faster cash flow = faster growth

🔧 Strategies to Improve Your CCC

| Component | Strategy |

|---|---|

| DIO | Improve inventory turnover, forecast demand, reduce waste |

| DSO | Tighten credit terms, incentivize early payments, automate collections |

| DPO | Negotiate longer payment terms, extend payables without penalties |

🧠 Final Thoughts

The Cash Conversion Cycle is more than just a financial formula — it’s a lens into your operational and financial health. By reducing delays across inventory, collections, and payments, you can unlock faster cash flow, reduce financing needs, and grow your business with confidence.